How We Help

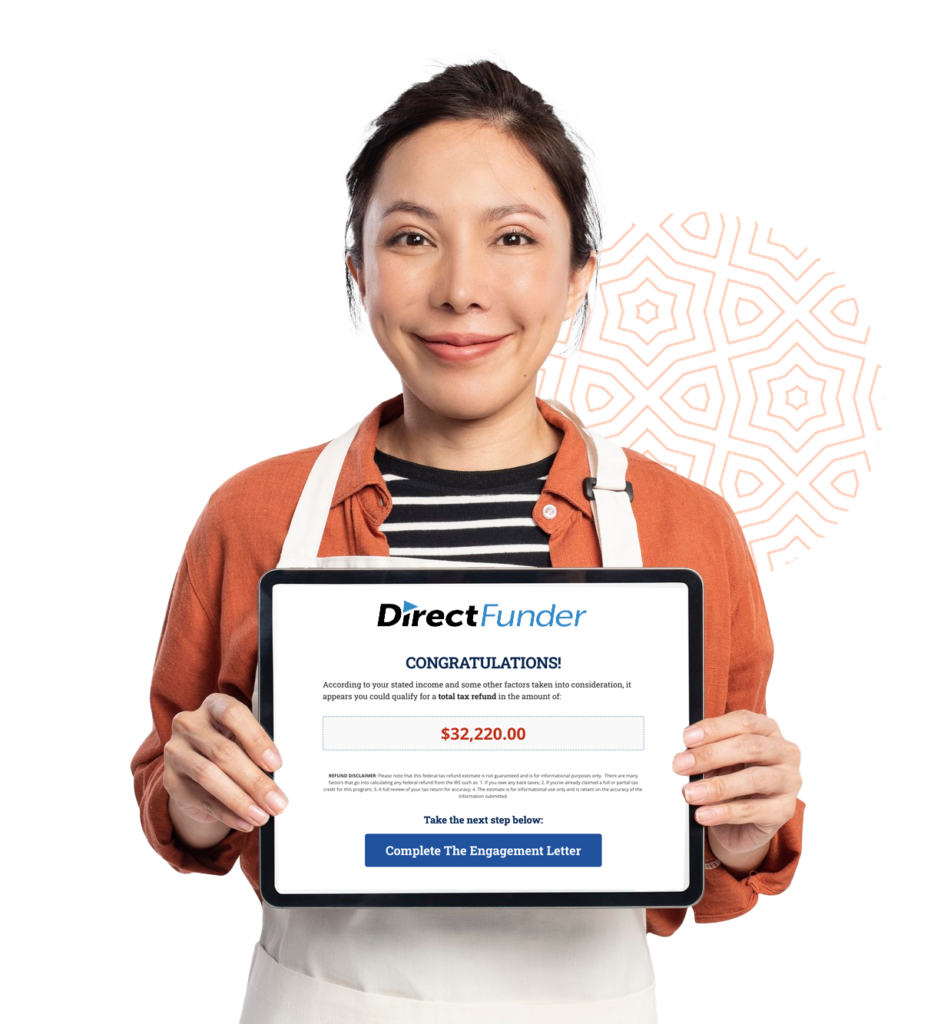

We Get Self-Employed Workers Like You the Money You Deserve

Direct Funder, LLC, works with you to simplify and expedite the FFCRA tax refund process. Our process, managed by Certified Public Accountants (CPAs), takes the guesswork out of calculations and the complexities of tax-related queries.

We handle every aspect, from amending your tax returns to submitting your application to the IRS, allowing you to focus on what truly matters—growing your business.

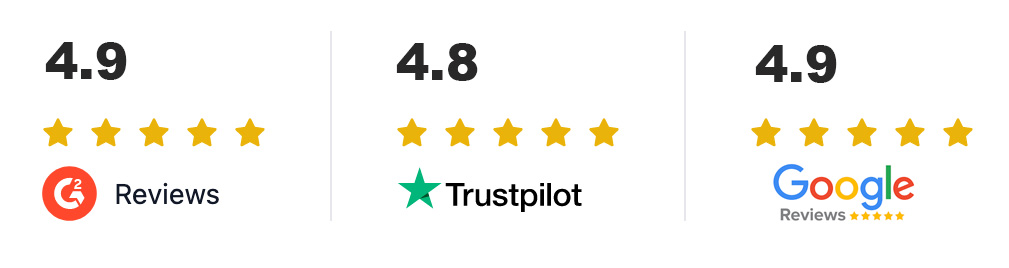

FAST, RELIABLE, ACCURATE PROCESSING

We take pride in providing you with a tax processing experience that is not only reliable but also lightning-fast and incredibly precise. Our commitment to accuracy ensures that your tax matters are handled with the utmost care, saving you both time and money.

128 BIT SSL SECURITY OF YOUR DATA AND DOCUMENTS

Your data and documents are your most valuable assets, and we treat them with the highest level of security. Our cutting-edge 128-bit SSL encryption safeguards your information, guaranteeing that it remains confidential and protected from any unauthorized access.

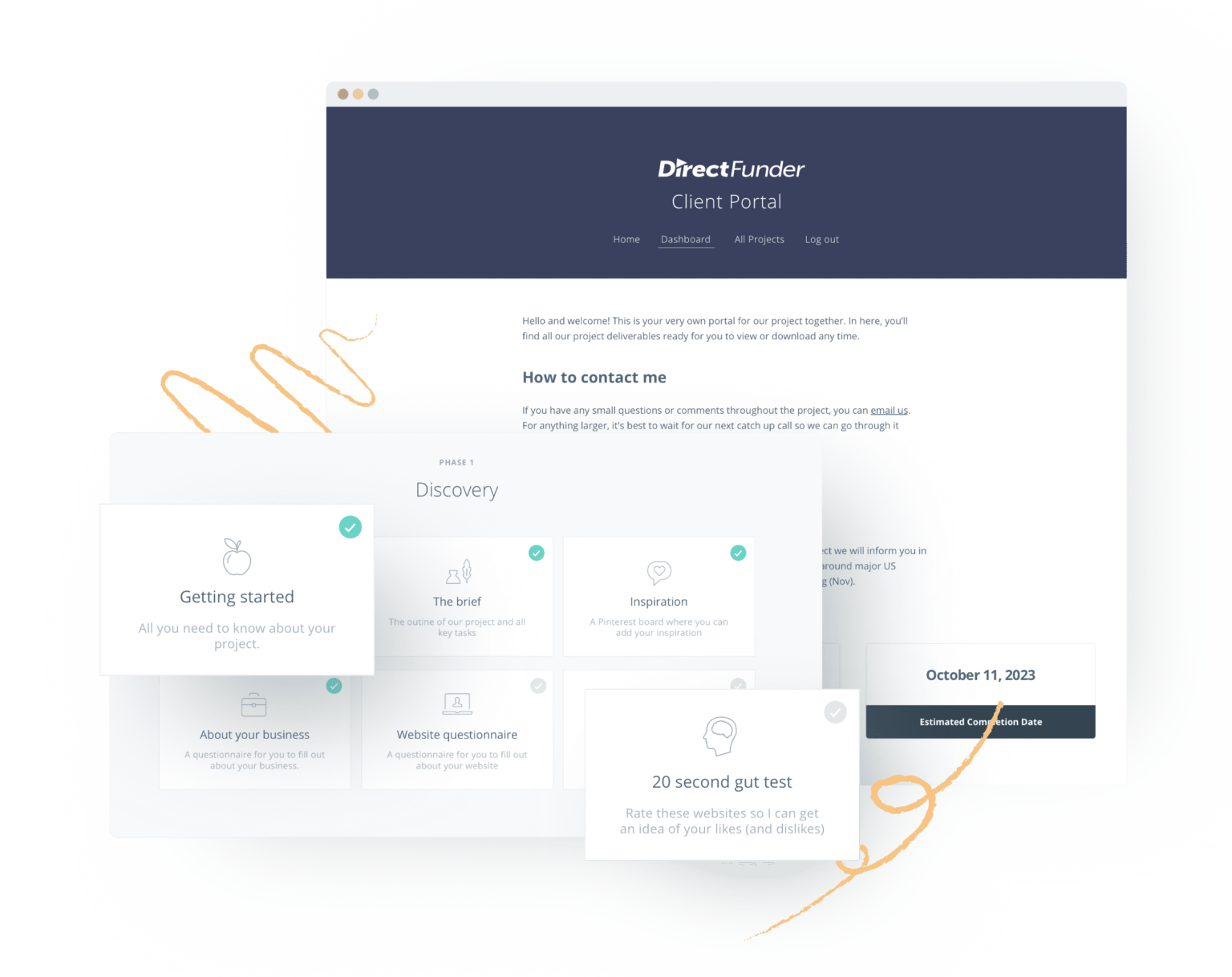

PROPRIETARY SYSTEM BUILT AND MANAGED BY TAX EXPERTS

Our proprietary system is more than just a tool; it's the brainchild of our seasoned tax experts. We've designed and meticulously manage this platform to ensure it addresses your unique tax needs effectively. You can trust that you're in the hands of true professionals who understand the nuances of the tax world.